Retiring from Chevron

We are commonly asked about certain Chevron benefits, and how they affect retirement:

- Employee Savings Investment Plan (ESIP)

- Employee Savings Restoration Plan (ESIP RP)

- Chevron Incentive Plan (CIP)

- LTIP Stock Options

- Stock Options (ISO) and Non-Qualified Stock Options (NQSO)

- LTIP Performance Shares

- LTIP Restricted Stock Units

- The Chevron Retirement Plan (CRP)

- Chevron Retirement Restoration Plan (RRP)

Retiring from Chevron

We are also often asked…

Retiring from Chevron

Sample Retirement situation that we help with:

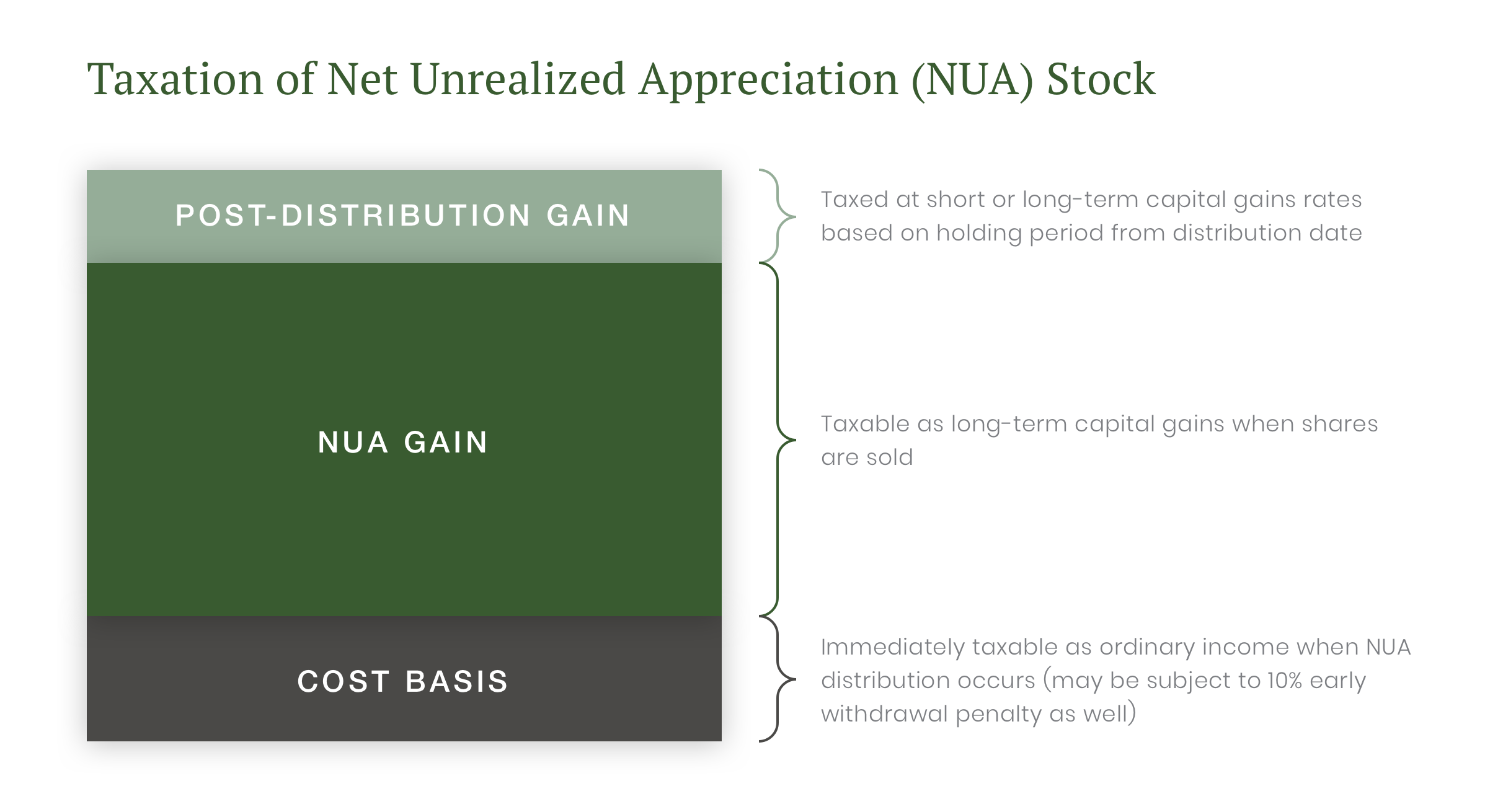

- Sally Saver is looking to retire, she has $300,000 of CVX in her ESIP account plus around $400,000 of mutual funds.

- The CVX stock has a basis of $71,000

- Sally has a few options to move the funds out of the company 401k plan, as mentioned there are some tax saving strategies available.

- Sally can distribute her ESOP Chevron shares into a brokerage account, the $71,000 would be taxable at ordinary income rates in the current year but the difference $229,000 ($300,000 CVX value – $71,000 cost basis) would have the option to be taxed at long term capital gains rate in accordance with tax law.

- Sally would then roll the $400,000 of mutual funds over to an IRA, and take distributions as needed with the understanding that any money coming from the IRA account is taxed as ordinary income.